A Guide to E-invoicing in Malaysia: A CFO’s Perspective & Strategies

What is this mandatory e-invoicing in Malaysia?

The Inland Revenue Board Malaysia (IRBM) has recently announced that they are targeting 4,000 businesses for the first stage of new electronic invoicing or e-invoicing system in Malaysia. This is mandatory enforcement for all businesses that will start to commence based on phases. In this article, we will cover the case of companies with multiple subsidiaries and what challenges may arise, strategies and best practices to overcome. Lastly, what are the ERP (Enterprise Resource Planning) software or systems available in Malaysia? Let’s start with IRBM’s e-invoice initiatives.

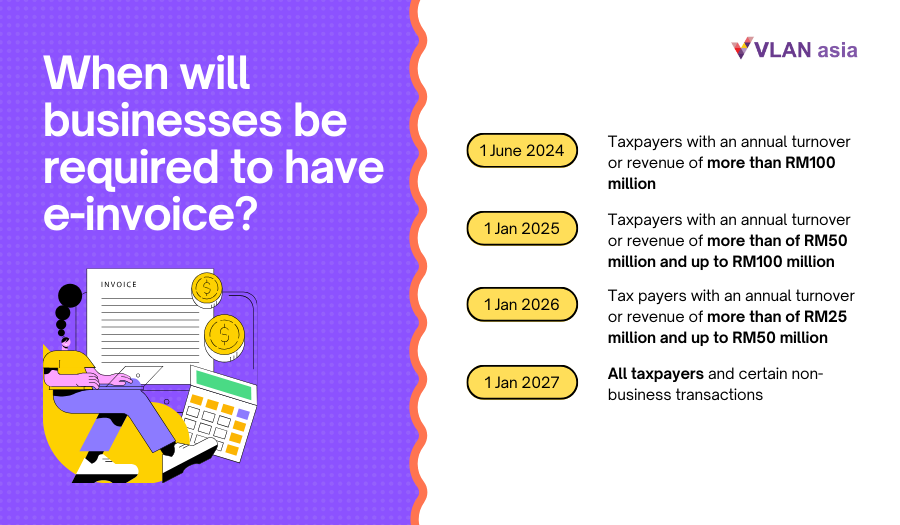

Will Malaysia introduce a countrywide e-invoicing from June 2024?

According to LHDN, in an effort to improve the effectiveness of Malaysia’s tax administration management and assist in the digital transformation of the country, the government plans to deploy e-invoices in phases. The motive is in line with the 12th Malaysia Plan, which placed a strong emphasis on digitising tax administration and building an infrastructure for digital services. With the use of electronic invoicing, transactions for B2C, B2B, and B2G transactions can be validated and stored almost instantly. Mandatory implementation for Malaysian business 2024 to 2027

What is the proposed timeline?

Mandatory Implementation will be based on turnover or revenue thresholds and will be implemented in phases starting from 1 June 2024.

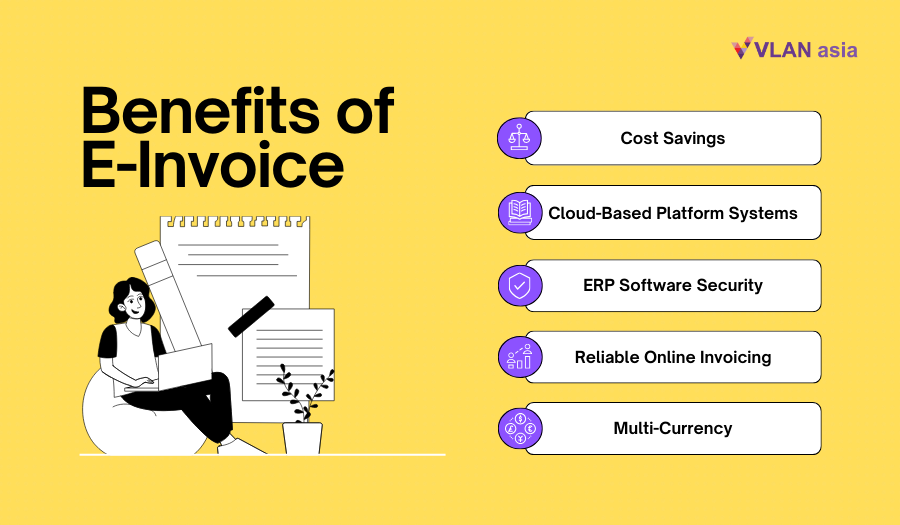

The benefits of e-invoicing over traditional invoice

In a digital growing economy, e-invoicing is growing in popularity among B2C, B2B and B2G sectors which are gradually replacing old-fashioned paper invoices. Based on recent events, the concept of e-invoicing has been accelerated by the Malaysian IRBM in invoicing business transaction. As a result, the benefits of e-invoicing are becoming well known.

On one hand, the shift means changing the invoicing processes of businesses – something that can be viewed as ‘sudden’ changes for the nation. On the other hand, e-invoicing provides many advantages to companies with multiple subsidiaries, supply chain businesses, inventory management and more. This is where Cloud ERP (Enterprise Resource Planning) Software comes into picture to solve the nation’s concerns regarding e-invoice implementation. This section of the article shall explain the benefits of cloud ERP software for your business.

-

Cost savings: Cloud ERP system can reduce the upfront and ongoing costs of hardware, software, maintenance, and security. You only pay for what you use, and you can scale up or down as your business needs change.

-

Cloud-Based Platform Systems: A cloud-based system allows users to access their data remotely. Making it easier for users to access, collaborate and share information with their team members.

-

ERP Software Security: If security and data is your concern, don’t worry! There is cloud ERP solution in Malaysia such as Oracle Netsuite that will backup and protect your data 24/7

-

Reliable Online Invoicing: A reliable ERP system always gets payments done faster through the process of automation, convenience, time saving, digital paper trail and contact-free delivery.

-

Multi-Currency: Modern problems come with modern solutions. Businesses with subsidiaries in different geographic locations will not have to be concerned with manual conversions as software's like Oracle Netsuite will do the currency exchange for you.

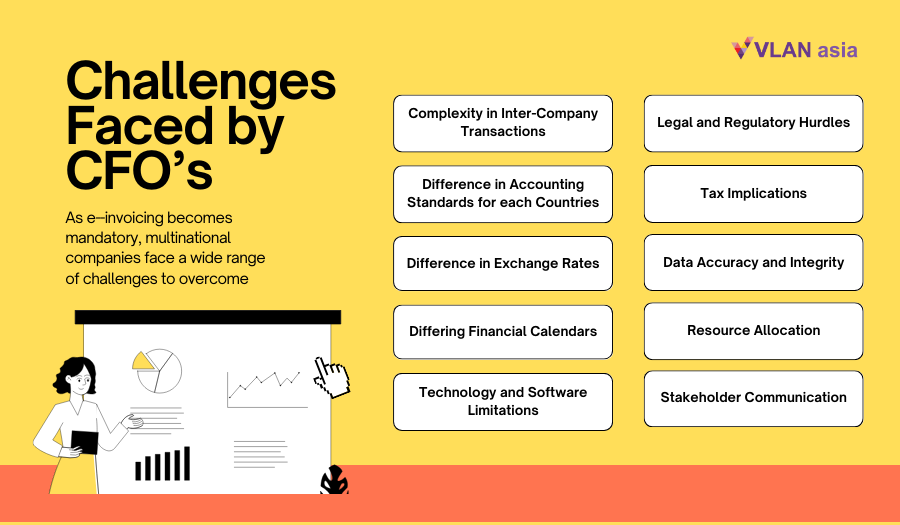

Challenges faced by CFOs of multinational companies

"What if I have multiple subsidiaries, how do I unify all my financial information?"

VLAN Asia’s CFO says that with experience in managing finances for various multinational corporations, they’ve seen the complex nature of inter-company financial management. Businesses with multiple subsidiaries find it tough to combine their financial accounts. Consolidation involves combining the financial statements of a parent company and its subsidiaries to give a comprehensive financial overview. Here are the key challenges in this process:

-

Complexity in Inter-Company Transactions: CFO’s must ensure that all inter-company transactions are properly recorded and accounted for. This process can be complicated, especially when there are multiple transactions spread across various geographies. These transactions need to be eliminated during consolidation to avoid double-counting.

-

Difference in Accounting Standards for each Countries: Different countries have their own accounting standards (e.g., US GAAP, IFRS). A company with subsidiaries in multiple countries may need to reconcile these differences to produce a consolidated report.

-

Difference in Exchange Rates: With global operations come multiple currencies. The fluctuations in exchange rates can significantly impact the consolidated financials. Choosing the right method (current rate method, temporal method) and timing for currency translation is crucial.

-

Differing Financial Calendars: Not all subsidiaries might close their books at the same time. This disparity can make the consolidation process inconvenient, especially when trying to capture the most recent financial data.

-

Technology and Software Limitations: While there are several sophisticated software solutions available for consolidation, there will be mismatches in systems used by the parent and subsidiary companies. Hence, leading to integration issues.

-

Legal and Regulatory Hurdles: Mergers, acquisitions, and the establishment of new subsidiaries often come with regulatory requirements. Meeting these mandates, especially in a continually evolving global regulatory environment, can pose a challenge.

-

Tax Implications: Each subsidiary will be subjected to its country’s tax regulations. Understanding and effectively managing tax liabilities across multiple jurisdictions is a massive task.

-

Data Accuracy and Integrity: With so many entities providing financial data, ensuring accuracy and data integrity is paramount. One subsidiary’s error can ripple through and distort the consolidated financial statement.

-

Resource Allocation: The manpower and hours required to gather, verify, and consolidate accounts can be immense. This often leads to increased costs and potential delays in reporting.

-

Stakeholder Communication: Consolidated accounts are a summation, which may sometimes lack the granularity some stakeholders seek. Balancing transparency with the need for a clear, concise report can be challenging.

To navigate these challenges, businesses must invest in strong online invoicing ERP systems, robust processes, and continuous training. It’s also essential to maintain open channels of communication with all subsidiaries and ensure alignment with financial reporting standards and practices.

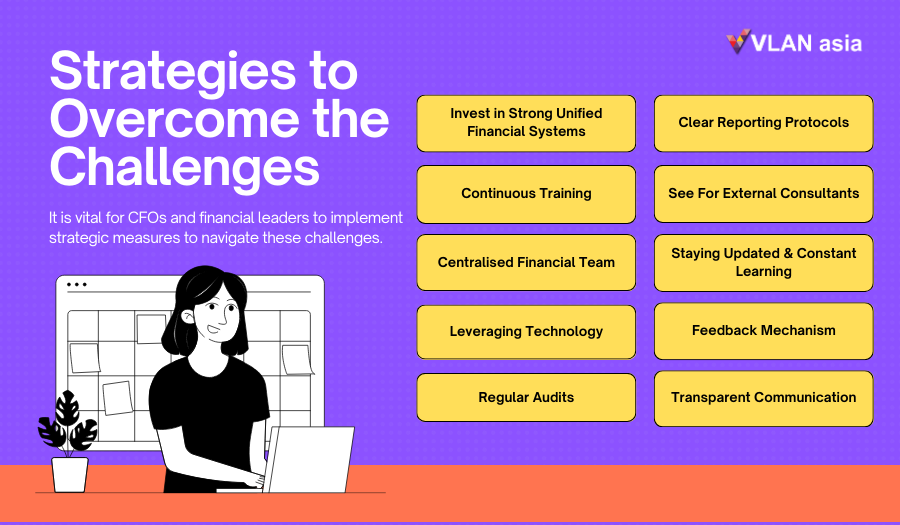

Strategies to Overcome Consolidation Challenges: Continuing the CFO’s Perspective

Given the manifold challenges in accounts consolidation for businesses with multiple subsidiaries, it becomes vital for CFOs and financial leaders to implement strategic measures to navigate these challenges. Here are some strategies and best practices:

-

Invest in Strong Unified Financial Systems: One way to streamline consolidation is by investing in financial systems and processes that are designed to handle and scale up the complexities of managing multiple subsidiaries. This can include implementing a centralized accounting system that can be used across all subsidiaries as well as developing a standardized process for financial reporting and invoicing.

-

Continuous Training: Ensure everyone is on the same page by providing regular training sessions for finance teams across subsidiaries. This involves everything from software usage to reporting standards. Such training initiative can drastically reduce errors and misunderstandings among stakeholders

-

Centralised Financial Team: Some conglomerates have found success by centralising their financial teams. This way, a single team handles financial processes for multiple subsidiaries, ensuring consistency and reducing complexities.

-

Leveraging Technology: Automation and AI-driven tools can be incredibly effective in handling mundane tasks and large data sets, identifying discrepancies, and even predicting currency fluctuations. These tools can significantly reduce manual workload and improve accuracy.

-

Regular Audits: Identify periodic internal audits to identify errors and discrepancies early. By ensuring each subsidiary maintains high standards of financial reporting, the consolidation process becomes smoother.

-

Clear Reporting Protocols: When consolidating, it is important to establish a standardized reporting protocal to ensure data consistency. This could include standardise templates, reporting timelines, checklists and more.

-

See For External Consultants: Getting an external financial consultant who specializes in global financial consolidation can be invaluable as they have the ability to offer insights into the potential pitfalls and best practices. Additionally, these consultants can train internal team to assist in system integration.

-

Staying Updated & Constant Learning: Given that accounting standards and regulations are always evolving, it’s vital for financial teams to stay updated. Regular workshops, webinars, and courses can ensure the team is always informed of the latest changes.

-

Feedback Mechanism: Creating a feedback loop with subsidiaries can help identify recurring challenges. By addressing these challenges at the root, companies can continually refine their consolidation process.

-

Transparent Communication: It’s crucial to keep stakeholders informed about the consolidation process, timelines, and any potential challenges. Transparency can build trust and ensure that stakeholders have realistic expectations.

With the right strategies, tools, and an emphasis on continuous improvement, CFOs can transform this intricate process into a systematic, streamlined, and insightful exercise. It’s all about foresight, adaptability, and the pursuit of financial clarity and accuracy.

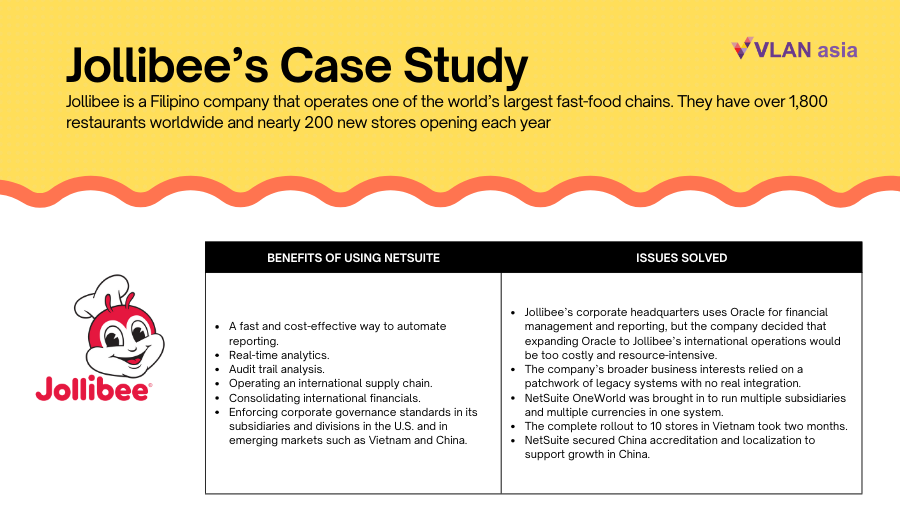

Short Case Study of Jollibee’s case

Summary: Jollibee is a Filipino company that operates one of the world’s largest fast-food chains. They have over 1,800 restaurants worldwide and nearly 200 new stores opening each year.

Jollibee brought in NetSuite OneWorld to run multiple subsidiaries and multiple currencies in one system. The complete rollout to 10 stores in Vietnam took two months. NetSuite secured China accreditation and localization to support growth in China. Jollibee’s corporate headquarters uses Oracle for financial management and reporting, but the company decided that expanding Oracle to Jollibee’s international operations would be too costly and resource intensive. As a result, the company’s broader business interests relied on a patchwork of legacy systems with no real integration.

The benefits of using oracle netsuite for jollibee:

- A fast and cost-effective way to automate reporting.

- Real-time analytics.

- Audit trail analysis.

- Operating an international supply chain.

- Consolidating international financials.

- Enforcing corporate governance standards in its subsidiaries and divisions in the U.S. and in emerging markets such as Vietnam and China.

Issues that Oracle Netsuite managed to resolve for Jollibee

- Jollibee’s corporate headquarters uses Oracle for financial management and reporting, but the company decided that expanding Oracle to Jollibee’s international operations would be too costly and resource-intensive.

- The company’s broader business interests relied on a patchwork of legacy systems with no real integration.

- NetSuite OneWorld was brought in to run multiple subsidiaries and multiple currencies in one system.

- The complete rollout to 10 stores in Vietnam took two months.

- NetSuite secured China accreditation and localization to support growth in China.

How can VLAN Asia Help?

VLAN Asia can help by suggesting an ERP solution available in Malaysia. The solution is Netsuite’s OneWorld Cloud ERP system (True Cloud, Netsuite’s term for their Cloud ERP).

Cloud ERP stands for enterprise resource planning (ERP) system that runs on a vendor’s cloud platform as opposed to an on-premises network, allowing organizations to access over the internet. ERP software integrates and automates essential financial and operational business functions and provides a single source of data, including inventory, order and supply chain management and help with procurement, production, distribution and fulfilment. Organizations access the software over the internet, so all that’s needed is connection and a browser.

Netsuite termed their Cloud ERP as the True Cloud. Netsuite’s powerful Cloud ERP (True Cloud) system in Malaysia connects all process of the business together, from finance, inventory management to procurement process, this system allows businesses to see everything in one platform. Using an independent system will take 3 weeks to consolidate all financial information. However, Oracle Netsuite allows businesses to take personalisation to the next level through Cloud ERP system and advanced online invoicing capabilities.

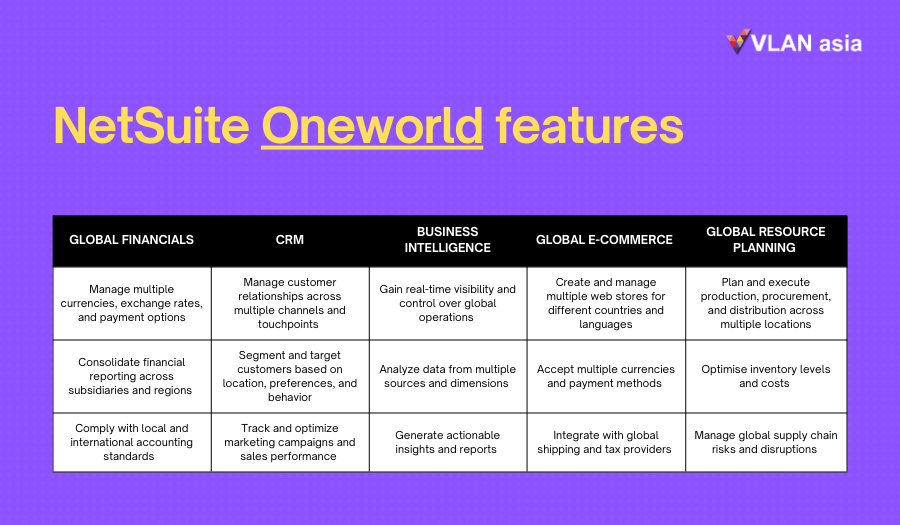

Netsuite OneWorld Features

Global Financials

- Manage multiple currencies, exchange rates, and payment options

- Consolidate financial reporting across subsidiaries and regions

- Comply with local and international accounting standards

Customer Relationship Management (CRM)

- Manage customer relationships across multiple channels and touchpoints

- Segment and target customers based on location, preferences, and behavior

- Track and optimize marketing campaigns and sales performance

Business Intelligence

- Gain real-time visibility and control over global operations

- Analyze data from multiple sources and dimensions

- Generate actionable insights and reports

Global E-commerce

- Create and manage multiple web stores for different countries and languages

- Accept multiple currencies and payment methods

- Integrate with global shipping and tax providers

Global Resource Planning

- Plan and execute production, procurement, and distribution across multiple locations

- Optimize inventory levels and costs

- Manage global supply chain risks and disruptions

To get more insights about how to harness the power of oracle netsuite and get industry insights, check out our past Oracle Netsuite Event that we did last June 2023.

ERP Malaysia and FAQs

Is VLAN Asia an ERP Provider? Yes and no. Yes, we are the ERP vendor Malaysia for Oracle Netsuite One World as a Cloud ERP (True Cloud) solution to your day-to-day business operations. VLAN Asia is a one-stop IT solutions provider that specialises in cloud solutions such as Microsoft 365, Zendesk, HubSpot, Acronis, Microsoft Azure and . With 18 years of experience, VLAN Asia has become a trusted end-to-end IT solutions provider for small, medium businesses (SMBs) and enterprise organizations across various industries and business models in Southeast Asia.

Is Oracle NetSuite the best e invoicing software in Malaysia? Oracle Netsuite Cloud ERP provides businesses with a 360 digital coverage of their business process. From accounting, financial reporting, customer relationship management (CRM), real time data updates, e-commerce management, inventory management, multiple entity management and consolidation.

Where do I find a form to the ERP application? You can apply and express your interest in Oracle Netsuite Cloud ERP solution via our link here <Insert product page link here>